When I started this blog, I bought shares in three categories: consumer staples, infrastructure-related companies and online portals. Nowadays, I only entertain the first category. First, I sold off all my tech companies during their wild share price movements in early 2023. The volatility made me realize that I don't fully comprehend what drives the valuations of these tech giants. In the case of Alibaba and Tencent, for example, the Chinese government has a particular interest and involvement, which seems impossible to gauge. In the case of Meta Platforms, there were concerns about the costs of its Metaverse, which I found equally impossible to evaluate.

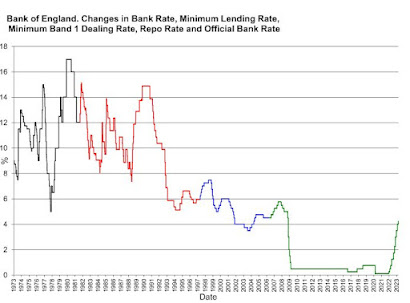

Mid 2023, I also started selling off my infrastructure-related companies and REITs. These types of stocks are easier to understand than tech. However, another reason to avoid this sector emerged: increasing debt burdens. Hard assets are almost always bought with leverage. I believe that interest rates will be higher for longer. I started by selling off particularly vulnerable companies like Ho Bee Land. Over the months, I grew increasingly uncomfortable with leverage, even for my holdings with relatively strong balance sheets. I scrutinized all my infrastructure-related holdings individually and made the following sell decisions.

Sold: Anhui Expressway Co Ltd (HKSE:00995), Qilu Expressway Company Ltd (HKSE:01576), Jiangsu Expressway Co Ltd (HKSE:00177)

The 'higher interest rates for longer' mantra may not apply to China, at least not for now. These toll road operators are not under immediate debt pressure, but I had other concerns. Chinese toll road operators generally do not disclose their concessions' end date. However, we can compare the total yearly amortization of the concession value with the total remaining concession book value. We then realize the average remaining concession is often only 10 - 15 years. After expiration, the toll road operator has no assets left unless it negotiates renewals for its concessions or gets new concessions. It's hard to gauge whether concessions will be renewed and at what price. Consequently, it's hard to establish a valuation for these operators. It's like a discounted cash flow formula with or without a terminal value. As I argued in the industrial S-REITS article, that means a huge difference in the DCF calculation result. I find the valuation calculations too uncertain to hold on to these toll road operators.

Sold: Qingdao Port International Co Ltd (HKSE:06198), China Merchants Port Holdings Co Ltd (HKSE:00144)

Qingdao Port announced a restructuring of its ports in the form of a combination with sister companies. They issued a 32-page document describing the transactions in legal language. Honestly, I could not get the gist of it. Qingdao Port is a Chinese state-owned enterprise (SOE). The transaction may have some political purpose rather than a business optimization goal. But again, I am puzzled about what was going on in the first place. I found that reason enough to sell. In the same light, I sold off China Merchants, also an SOE with investments outside China that I found hard to justify business-wise.

Sold: Suria Capital Holdings Bhd (XKLS:6521)

Another port operator, but this time in Malaysia. It is also an SOE, majority-owned by the state of Sabah. The holding contains all ports in Sabah and, as a monopoly, is doing well. However, the growth thesis is based on a large development project next to the port of Kota Kinabalu, which will offer residential and commercial properties. I have no particular insights into the Malaysian real estate sector. Frankly, I should have thought of that before buying the share. Suria Capital has no debt and may be an interesting share for investors who do have detailed insights into the sector.

Sold: China Tower Corp Ltd (HKSE:00788)

Back to mainland China. China Tower Corp is a joint venture of the three leading telecom operators within China: China Mobile, China Telecom, and China Unicom. These three operators sold their telecom towers to China Tower and leased them back. This is a standard construction within the telecom industry, but in this case, all four parties involved are SOEs. The construction makes sense, but there are also opportunities for transfer pricing. If not now, then in the future. It's hard to determine whether your interests as a foreign minority investor will always be considered.

Sold: CK Hutchison Holdings Ltd (HKSE:00001)

Well-known Hong Kong-based holding linked to the Li Ka-shing family. I held the share for over five years, during which its price dropped consistently. Thankfully, my overall loss is limited to only a few per cent, thanks to the high dividend payouts.

The interest coverage ratio (ICR) of the holding is around 4. The debt burden is not an immediate threat. Still, you could calculate a worse ICR depending on how you account for associate companies' income and debts. CK Hutchison's multiple holdings structure is complex. In any case, however you calculate the ICR, it has been dropping recently. It could fall further, considering CK Hutchison was still borrowing at an average interest rate of only 2.7% until recently. The credit ratings from Fitch and Moody's for Hutchison's debt are still solid, resp A- and A2. Even so, at the moment of selling, CK Hutchison had the highest debt levels among my portfolio companies.

Sold: Hutchison Port Holdings Trust (SGX:NS8U)

Together with CK Hutchison, I also sold its associate Hutchison Port Holdings Trust (HPHT), a business trust listed in Singapore. Its debt burden is increasing. I calculated an ICR of about 3.7 on 30 June 2023, but a lot of debt has to be re-negotiated soon, which will be at higher rates in the current interest rate environment. Profits will increasingly be re-directed from dividends to interest payments and debt repayments.

Let me also address the assets' life expiry issue for this trust. HPHT indicates that the concessions for its ports expire from 2038 to 2055. They don't provide the details to calculate a weighted average expiry, but in the case of its Hong Kong ports, it is June 2047. (I assume this date is related to the expiry of the Special Administrative Region status of Hong Kong.) On the other hand, HPHT currently offers a dividend yield of more than 10%. The investor seems sufficiently compensated for the risk that the port concession will not be extended to HPHT. The debt burden, rather than the concession expiries, turned me away from the stock.

The low ROIC of infrastructure stocks

To conclude this blog, an observation about another issue: low return-on-invested-capital (ROIC) yields. Almost all infrastructure-related stocks have low ROIC yields; let's take 4% as an example. This does not immediately seem a big issue when you buy the stock at a price-to-book lower than 1. Infrastructure-related stocks are often quoted at P/B < 1, meaning that the return-on-investment of your recently invested dollar is higher than 4%, for example, in the form of a 10% cash dividend yield, like in the case of HPHT.

So far, so good, until your new company starts making new investments to either expand into new assets or refurbish existing assets. These new investments are most likely again at the typical low 4% yield for infrastructure and real estate. The free cash flows for the high dividends you enjoyed will be redirected to investments with a 4% ROIC, which you probably do not appreciate. In the long term, your low P/B bargain becomes a trap. I believe this is the mechanism Charlie Munger referred to in the following quote.

Over the long term, it is hard for a stock to earn a much better return than the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you re not going to make much different than a six percent return even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result. So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects. How do you get into these great companies? One method is what I'd call the method of finding them small - get 'em when they're little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it's a very beguiling idea. If I were a young man, I might actually go into it.

(Charlie Munger, Poor Charlies Almanack, 3rd Edition, Page 206. "The art of stock picking")

Disclosure: No positions in Alibaba, Tencent, Meta, Anhui Expressway, Ho Bee Land, Qilu Expressway, Jiangsu Expressway, Qingdao Port, China Merchants Port Holdings, Suria Capital, China Tower, China Mobile, China Telecom, China Unicom, CK Hutchison, Hutchison Port Holdings Trust, and Wal-Mart