I liquidated my Ho Bee Land (SGX:H13) position on 18 Apr 2023 for SGD 2.21, realizing a loss of ~20%, including dividends received. Considering the rising interest rates, I fear Ho Bee Land's debt is too high.

Ho Bee Land is almost a REIT considering the high amount of investment properties compared to the projects they still have in development. Like a REIT, its net debt level is also relatively high at almost 13 times EBITDA. The interest coverage rate is 2.9, which is low but not immediately alarming. However, when you flip through the Ho Bee Land 2022 Annual Report, you learn that it was borrowing at rates of only 1.02 - 1.61 % (page 74) in 2021. Already in 2022, this range expanded to 1.05 - 5.05 %. What would eventually happen if all their loans were charged a 5% interest rate or higher? When your finance costs rise fivefold, the lease payments of the tenants will also have to grow five times just to keep the interest rate coverage stable.

Raising rents fivefold is highly unlikely, even in an inflationary environment. However, Ho Bee Land has another trump card to play: their borrowings are currently hedged with interest rate derivatives. In 2022, we can already see these derivatives creating value (annual report page 75), and they will keep working for them if interest rates stay high. Unfortunately, we must consider what will happen after these hedges expire. All derivatives are tied to specific loans, which mature from 2023 - 2026 (page 74). These loans will have to be refinanced, and obviously, you can not continue to lock in a 1% interest rate with derivatives when the general interest rate environment is already much higher. Thus, Ho Bee Land can only pray that the interest rates will drop again in the coming years. Here, we arrived at the crux of my fear.

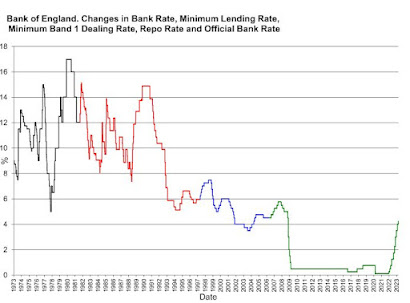

Most of Ho Bee Land's investment properties are in the UK. I could not find a reliable source for historic commercial real estate lending rates. The graph shows the historic Bank of England Bank Rates. It is the interest rate that banks receive for holding money with the BOE. This data will also prove my point.

|

|

(Source: excel data from https://www.bankofengland.co.uk/boeapps/database/Bank-Rate.asp) |

- Fluctuating around 11% from 1973 till 1993

- Fluctuating around 5% from 1993 till 2009

- Near 0.5% from 2009 till 2022

From observing this pattern, the current 5% rate is unlikely to be followed by a reversal back to the 0.5% regime. Apart from another 1978 type of exception, it is likely that we will see the 5% level sustained over a longer term. In other words, it looks like there is a new regime of mid to high interest rates. This is a bit of an engineering type of pattern recognition. If you have strong economic reasons to disagree that interest rates remain elevated for longer, there is no reason to worry about Ho Bee Land. Their balance sheet is quite strong now. They will gracefully survive a short period of high interest rates. However, if you agree that there might be an interest rate regime change, the coming years look bleak for Ho Bee Land. Not only for them but also for many REITs and other real estate holders facing the same issue: lots of debt with low interest rates, locked in for a few years but expiring in a potentially higher interest rate environment.

One remedy for leveraged property owners is to simply sell off properties and repay the debt until it is no longer a burden. But who is going to buy those properties from them? Even if it is a high-quality office in London? Most other real estate investors are also leveraged and facing the same rising interest rate issue. Adding more fuel to the fire, cap rates generally rise together with interest rates, so estimated values of properties will go down. Ho Bee Land actually started selling off some properties in Singapore. However, I wonder if this strategy can reduce the debt burden enough to stop worrying about it. (NB: Ho Bee Land stated that those property sales are unrelated to debt pressures.)

Disclosures: I am not a real estate professional. Nothing written here is investment advice. I sold off Ho Bee Land and all my REITs except Daiwa House Logistics REIT. I will give more details in future blogs.